Andorra Tax Rates: a Complete Overview of the Andorra Taxation for

4.6 (385) In stock

Andorra offers favourable taxation regimes for individuals and companies. The income tax applies only to the annual amount exceeding €24,000. The corporate tax rate is 10%, and the VAT is 4.5%. Learn more about the effective rates, exemptions and how to become a tax resident of Andorra.

/_next/image/?url=https%3A%2F%2

Andorra, History, Facts, & Points of Interest

Tax in Adorra

a.storyblok.com/f/176292/1536x864/484ef9f9d4/andor

Taxes in Andorra - Andorra Lawyers

accountant and audit in Andorra Archives - Aparcand

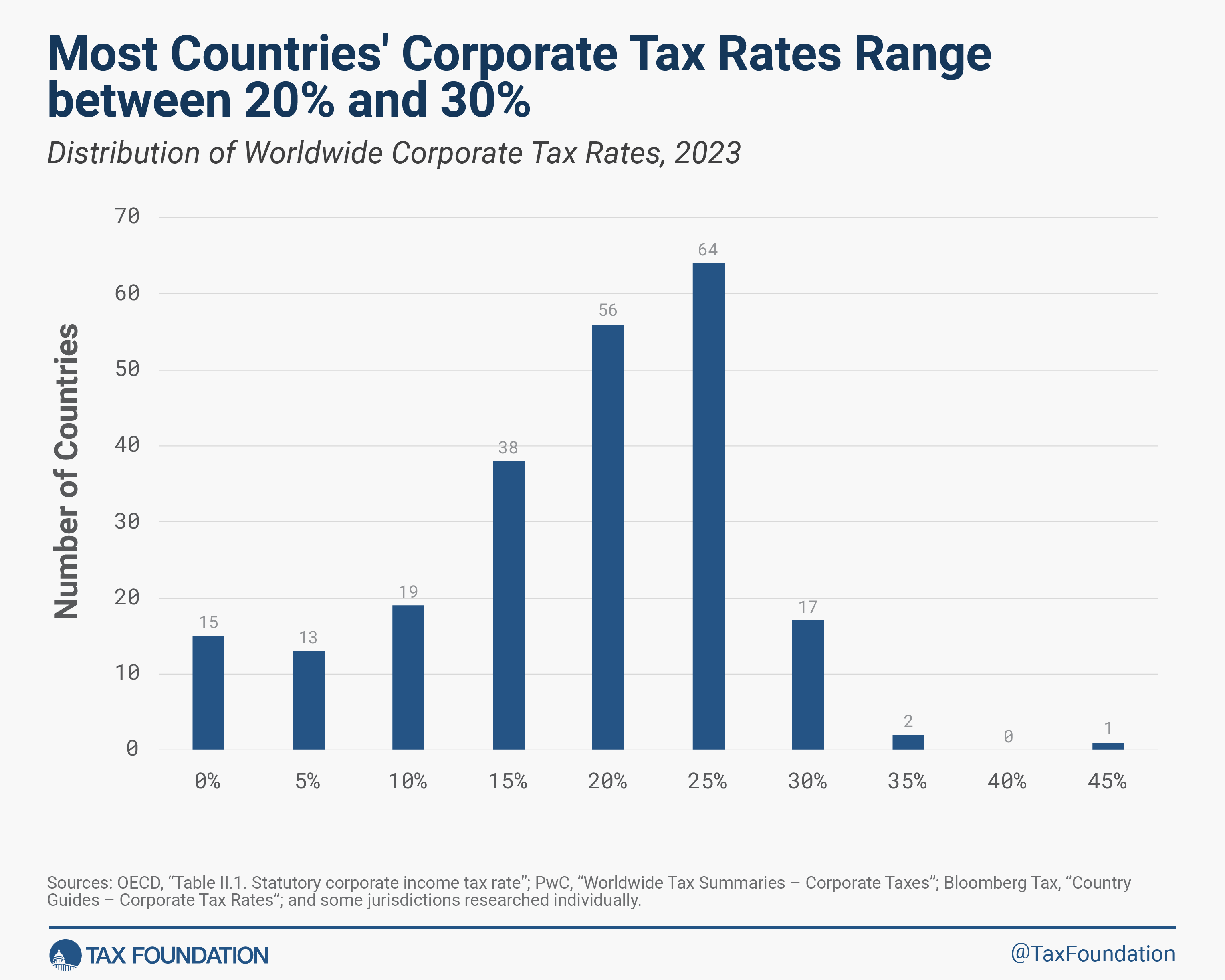

Corporate Tax Rates around the World, 2023

Taxation in Andorra: one of the most favourable in Europe

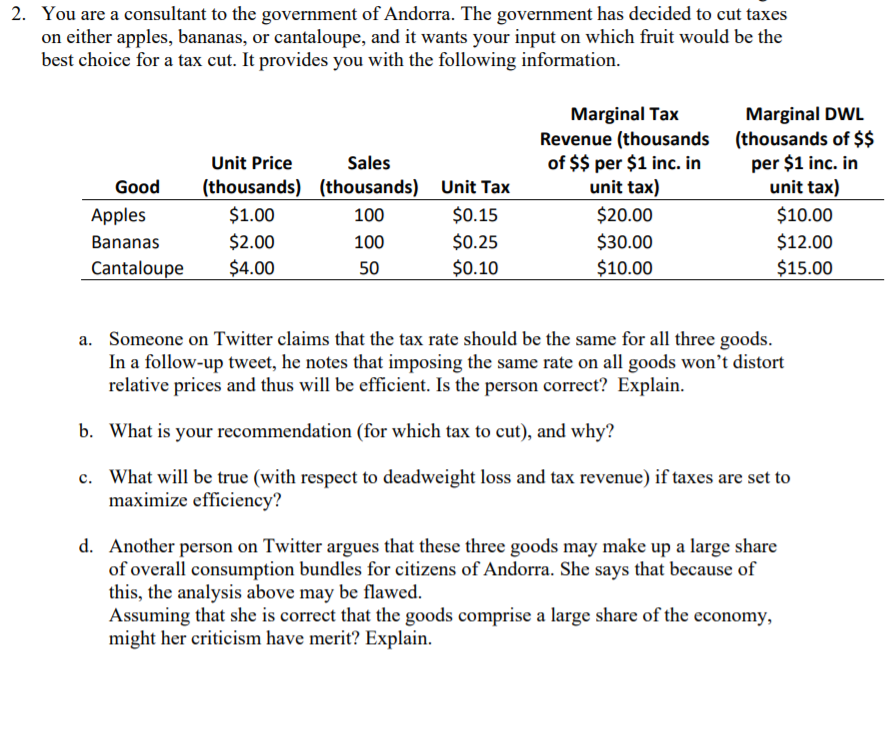

2. You are a consultant to the government of Andorra.

Solved Page 3 2. You are a consultant to the government of

The Full 2024 Guide to Andorra Taxes

Andorra Tries to Head Off a r-Fueled Housing Crunch - Bloomberg

Employer of Record & Payroll Services in Andorra

Visit World - Tax Residence in Andorra: how to get a residence permit and become a tax resident

Andorra: RTVA confirms non participation in Eurovision 2021

:quality(80):fill(white)/https:%2F%2Fimages.asos-media.com%2Fproducts%2Fadidas-originals-centre-stage-leggings-with-mesh-detail-in-black%2F203299851-1-black%3F$XXL$)