IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

4.8 (384) In stock

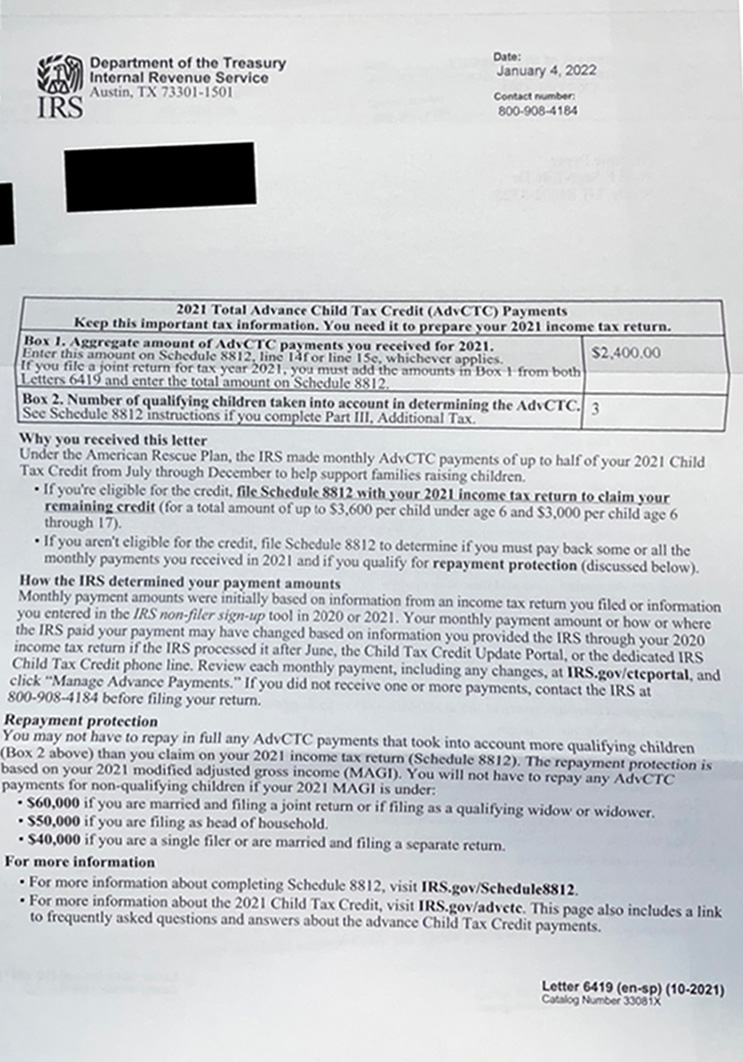

Have you received a 1099-K, 1099-B or 1099-MISC form about your crypto? Here’s what you need to know about 1099 forms and what it means for your crypto taxes.

Everything you need to know about IRS form 1099-MISC for 2023 Tax Year

Form 1099-K vs 1099-MISC vs 1099-NEC: What's the difference?, by TaxBandits - Payroll & Employment Tax Filings

There's A New Tax Form - With Some Changes - For Freelancers & Gig Workers

Tax Documents to Bring Pacific Northwest Tax Service

.jpg)

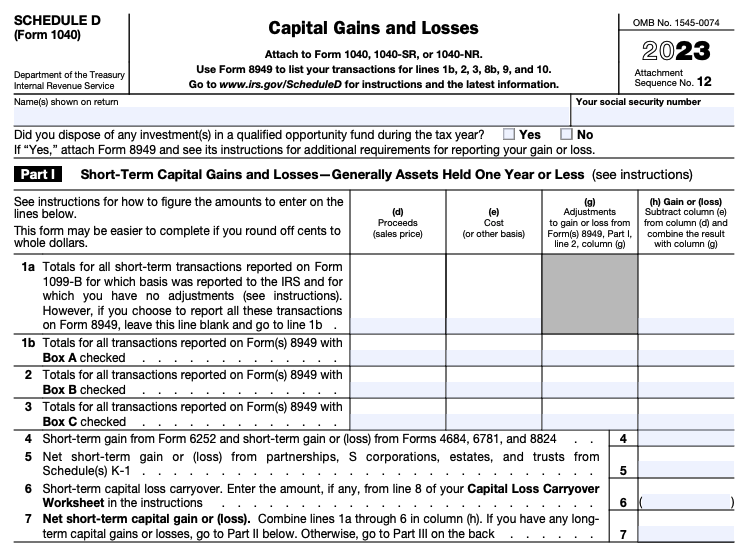

Crypto 1099 Forms: Investor's Guide 2024

Clarifications and Complexities of the New 1099-K Reporting Requirements - CPA Practice Advisor

Form 1099-MISC vs. 1099-NEC Differences, Deadlines, & More

A Guide To IRS Tax Forms - TaxBit

How to Report Crypto on Taxes in 2024

1099-MISC + 1099-K Solutions for Double Reporting + PayPal + Coinbase! — Steemit

:max_bytes(150000):strip_icc()/form-1099-c-understanding-your-1099-c-form-4782275_final-9a33850e37ad4d54839284865d5b507b.png)

Form 1099-C: Cancellation of Debt: Definition and How to File

Form 1099 K Vs 1099 Misc

From 1099 Crypto: Easy Instructions + Info [2024]

Battle Of The Bombers: Boeing B-52 Stratofortress Vs Rockwell B-1 Lancer

PEX A vs PEX B: Pros and Cons - Williams Plumbing

Virgin B-29 superfortress vs. Chad B-17 flying fortress. : r/virginvschad

Tu-160 Blackjack Vs B-1 Lancer: Copy or Not? - The Aviation Geek Club

- these pants are literally a dream 💭 so comfy and soft @Everlane #Eve

Introducing Chat with Retrieval-Augmented Generation (RAG)

Introducing Chat with Retrieval-Augmented Generation (RAG) Gaiam Cork Yoga Brick

Gaiam Cork Yoga Brick SAKE Stretchy Yoga Leggings, Yoga Pants Tights, High Waist Dance

SAKE Stretchy Yoga Leggings, Yoga Pants Tights, High Waist Dance Guess Men's Jogger

Guess Men's Jogger Mens Under Armour Football FTBL Jock Compression Shorts Spandex White Tights 3XL

Mens Under Armour Football FTBL Jock Compression Shorts Spandex White Tights 3XL