Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

4.8 (557) In stock

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

The Catholic Education Foundation is now a certified SGO!

Employment and labor laws in Ohio

Sales and Use - Applying the Tax

Soft money group raises $1 million to advance Frank LaRose's Ohio U.S. Senate bid • Ohio Capital Journal

508c1a Nonprofit Benefits and Requirements (Call Us Today!)

Free Cash Donation Receipt - PDF

Charity Registration - CHARITABLE OHIO

In Sheep's Clothing: United States' Poorly Regulated Nonprofit Hospitals Undermine Health Care Access

Ohio Attorney General Dave Yost - Services for Business

Nonprofit LLCs - Tax Law Research : Federal and Ohio - LibGuides at Franklin County Law Library

Understanding the Benefits of a Series LLC - Carlile Patchen & Murphy

File a Complaint - CHARITABLE OHIO

How to Start a Nonprofit in Ohio

Free American Red Cross Donation Receipt Template - PDF

Non-Profit Accounting: Definition and Financial Practices of Non

Non-Profit CRM Software Online Donor Relationship Management

Non-Profit Accounting: Definition and Financial Practices of Non-Profits

Womens Full Coverage Floral Lace Underwired Bra

Womens Full Coverage Floral Lace Underwired Bra- Purple Brand Jeans Brand New Sz.36 ‼️SOLD‼️ Now Available for purchase 620 Broadway Ave Seaside Ca 93955 Open 12-8pm daily

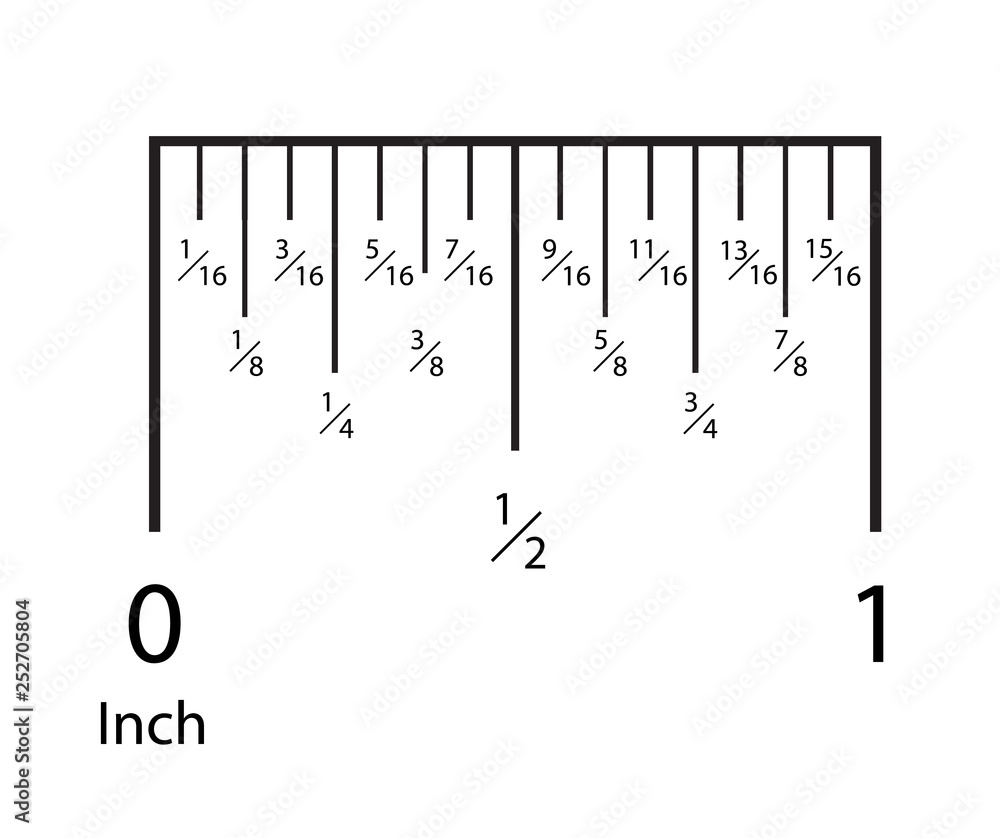

Inch rulers. Inches measuring scale indicator. Precision

Inch rulers. Inches measuring scale indicator. Precision- Everdry Waterproofing of Metro Detroit

Next Level 9384 Ladies' Cropped Pullover Hooded Sweatshirt

Next Level 9384 Ladies' Cropped Pullover Hooded Sweatshirt hollyann Marine Layer Anytime Fleece-Groovy Floral - HOLLYANN

hollyann Marine Layer Anytime Fleece-Groovy Floral - HOLLYANN