Income Tax Exemptions on Severance Payment for Employees

4.7 (242) In stock

Get to know income tax exemptions on severance payments for employees who are laid off. Also, we mention a short brief of sections 10 (10B), 10 (10C) and 89.

Taxing Severance Payments (Abfindungen)

Tax on Employment or Professional Tax Deduction - Taxmann

No Redundancy Payment Law in the US, But Smart Employers Do This

Supplemental Payments – Justworks Help Center

What is Severance Pay? Definition and how to calculate it - Shiftbase

Taxdot Services Private Limited

How Are Bonuses Taxed? - Ramsey

Severance Pay: What it is and Why it's Offered

How Severance Pay is Taxed

Is Severance Pay Taxable?

Are severance payments taxed? Employment tax - KPMG Ireland

130,000 veterans may be eligible for refund for taxes paid on

7 Reasons Why Companies Offer Severance to Employees

Confusions Over New I-T Rates Will Be Cleared in Budget 23-24

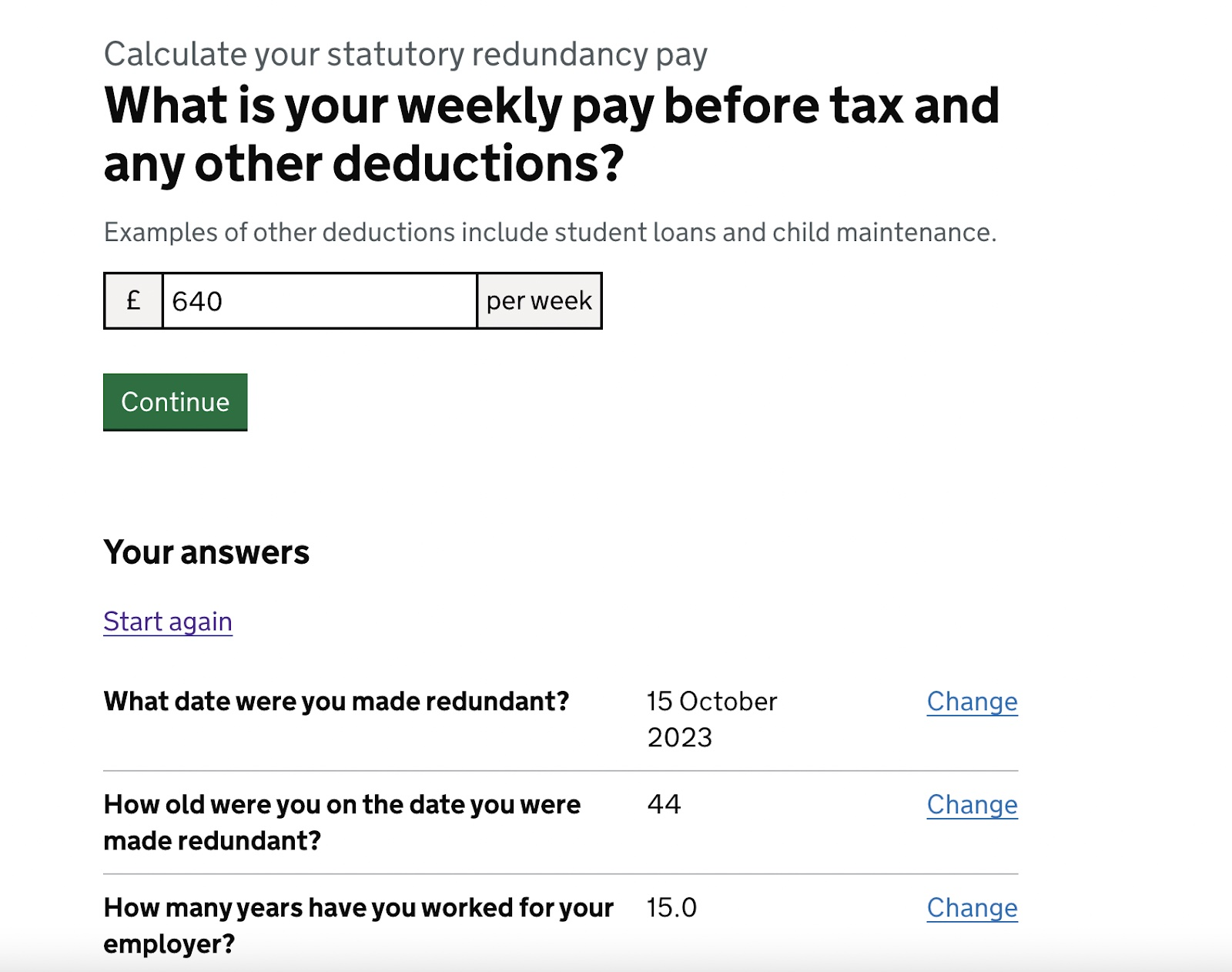

Calculation Of Severance Pay - FasterCapital

Severance Pay Meaning, Formula, Calculation, and Examples

Negotiating Your Severance Package (2024): The Ultimate How-To Guide

The Top Four Provisions to Look for in a Severance Agreement