Tie breaker Rule for an individual in International Taxation

4.7 (405) In stock

Article 4 deals with the provision, where an individual becomes a tax resident of the Country of Source as well as Country of Residence . I.

Canada US Tax Treaty Residency Tie-Breaker Rules - US & Canadian Cross-Border Tax Service - Cross-Border Financial Professional Corporation

International Taxation

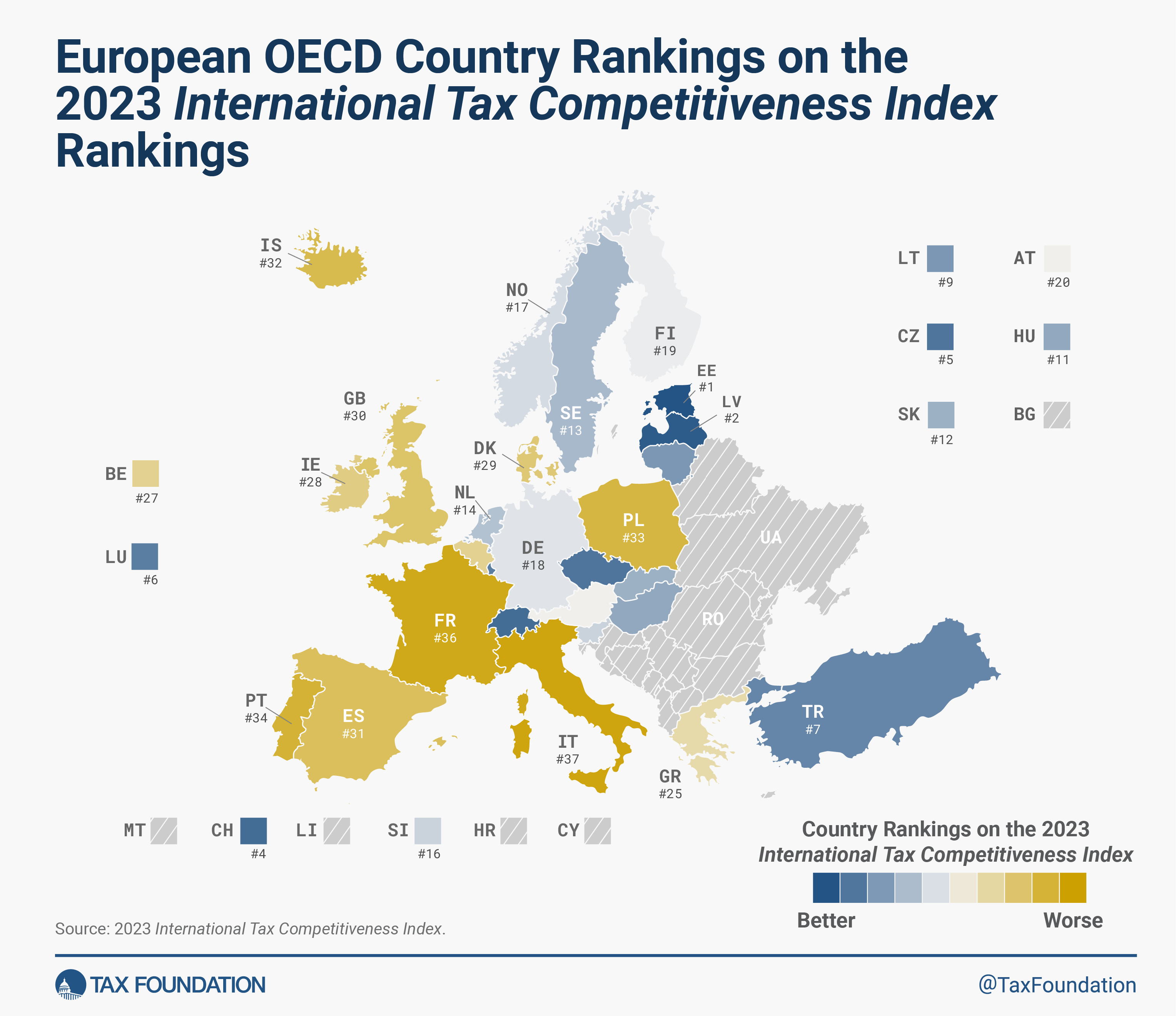

2023 International Tax Competitiveness Index

WHEN TO CONSIDER A PROTECTIVE 1120-F FILING - Expat Tax Professionals

A Guide to International Taxes when Working Remotely

CA Arinjay Jain on LinkedIn: #assocham #uaecorporatetax #uaetax

International Tax Updates - 30% Course Discount - Year End

Global Minimum Tax - New World New Tax Concept

Online Form 10F, PAN and No PE Declaration in India

Chapter 8 Are Tax Treaties Worth It for Developing Economies? in: Corporate Income Taxes under Pressure

CA Arinjay Jain on LinkedIn: #incometaxupdate #incometax

Tie breaker baby baby announcement

Tie-Breaker in Shareholders Agreement Defeats Deadlock Dissolution Petition

Bodycare Women's Full Coverage Perfect fitting Bra 6585 – Online

Bodycare Women's Full Coverage Perfect fitting Bra 6585 – Online MODULYSS UG WORLD Women's & Girls Nipple Cover Strapless Bra Instant Breast Lift Sticky at Rs 80/piece in Surat

MODULYSS UG WORLD Women's & Girls Nipple Cover Strapless Bra Instant Breast Lift Sticky at Rs 80/piece in Surat Awnmax Awning Fabric, Forest Green, 6107

Awnmax Awning Fabric, Forest Green, 6107 Soft Pink Glitter Watercolor Background Graphic by Dzynee

Soft Pink Glitter Watercolor Background Graphic by Dzynee- Colo(u)rs: Arctic Blue vs Ice Grey Metallic

Back Brace and Posture Corrector for Women and Men Adjustable And

Back Brace and Posture Corrector for Women and Men Adjustable And- Marie-Louise Tardif, députée de Laviolette–Saint-Maurice à l

- The Northern Cheyenne Tribe made history yesterday by electing

Adjustable Clay Model Stand, DIY Metal Pipe Clay Tools, with Wooden Base, Height Adjustable, Pottery Clay Support Holder Kit for Clay Modeling Sculpting Display Stand : : Home

Adjustable Clay Model Stand, DIY Metal Pipe Clay Tools, with Wooden Base, Height Adjustable, Pottery Clay Support Holder Kit for Clay Modeling Sculpting Display Stand : : Home Estos pantalones son la alternativa al vestido de verano, no son

Estos pantalones son la alternativa al vestido de verano, no son Johnnie Walker Black Label Whisky 40% 100 cl

Johnnie Walker Black Label Whisky 40% 100 cl